In the dynamic realm of private equity, evaluating potential investments’ operational and technological infrastructure is paramount for driving value creation. While typical due diligence might focus on identifying gaps in business systems, infrastructure (servers, telephony, etc.), and cybersecurity, there is a pressing need for investors and portfolio companies to delve deeper into the core business processes that interact directly with these systems. Notably, manual processes often persist around a company’s ERP systems due to legacy practices or because the benefits of automation offered by modern ERP solutions are overlooked. Understanding these core business processes is essential for private equity operating executives and deal teams, enabling accurate valuation and risk assessment, targeted improvements, and effective integration.

By identifying inefficiencies and potential risks, investors can make informed decisions on resource allocation to optimize cost efficiency and profitability. This profound insight also aids in planning seamless integrations, assessing scalability, and implementing continuous improvement strategies. Thus, it enables strategic investment decisions, including technology upgrades and synergy identification during mergers and acquisitions, ultimately driving significant value creation and positioning the company for long-term growth and competitive advantage.

Strategic Insights for Enhanced IT Due Diligence

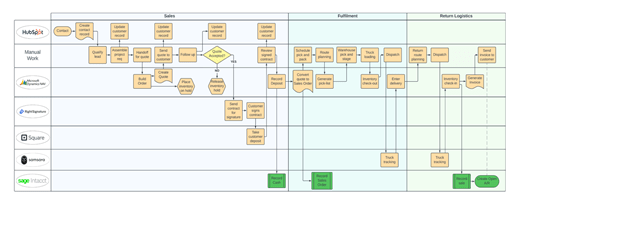

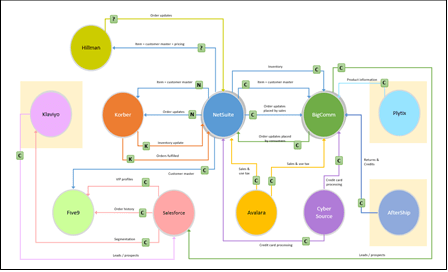

Business process flows are essential in documenting the intricate relationships between systems and manual processes. These mappings provide comprehensive insights that are invaluable to effective Day 1/100 planning. They allow private equity investors to assess the efficiency and effectiveness of a target’s technological and operational frameworks and prioritize initiatives to bridge any identified gaps. This phase often presents an excellent opportunity to reevaluate and optimize the use of the target’s ERP system, enhancing its functionality and reducing reliance on outdated manual processes.

Operational Efficiency and Strategic Planning

A clear depiction of existing processes enables investors to anticipate potential integration challenges and operational bottlenecks. This foresight is crucial for planning effective integrations that minimize disruption and ensure seamless transitions. Additionally, a deep understanding of these processes aids in strategically allocating resources post-acquisition, ensuring that technological investments are made where they can have the most significant impact. Not all integrations carry equal weight; sometimes, the effort and resources required may outweigh the benefits (“the juice is not worth the squeeze”).

Driving Digital Transformation and IT Strategy

During IT due diligence, the visualization provided by business process flows is crucial for evaluating the target’s application landscape. This analysis helps identify outdated systems, redundancies, and gaps that may require modernization or replacement. With this information, private equity firms can tailor their IT strategy to introduce cutting-edge solutions such as automation technologies, advanced analytics, and artificial intelligence, thereby boosting productivity and enhancing operational agility.

Accelerating Day 1/100 Planning and Post-Close Transformation

Effective business process mapping significantly accelerates Day 1/100 planning by equipping investors with a blueprint of critical operational areas that require immediate attention post-acquisition. These insights ensure that essential business functions continue without interruption, providing a robust foundation for subsequent transformation initiatives and long-term value creation.

Conclusion

The strategic deployment of business process flows transforms IT due diligence for private equity. These tools help safeguard investments and position portfolio companies for competitive superiority and robust growth. Compello Partners advocates for our clients to prioritize a comprehensive understanding and implementation of business process flows to capitalize on their investments fully.

Want to learn more?

Click here to schedule a call with a Compello Partners representative.